URA Tax Compliance Alert!

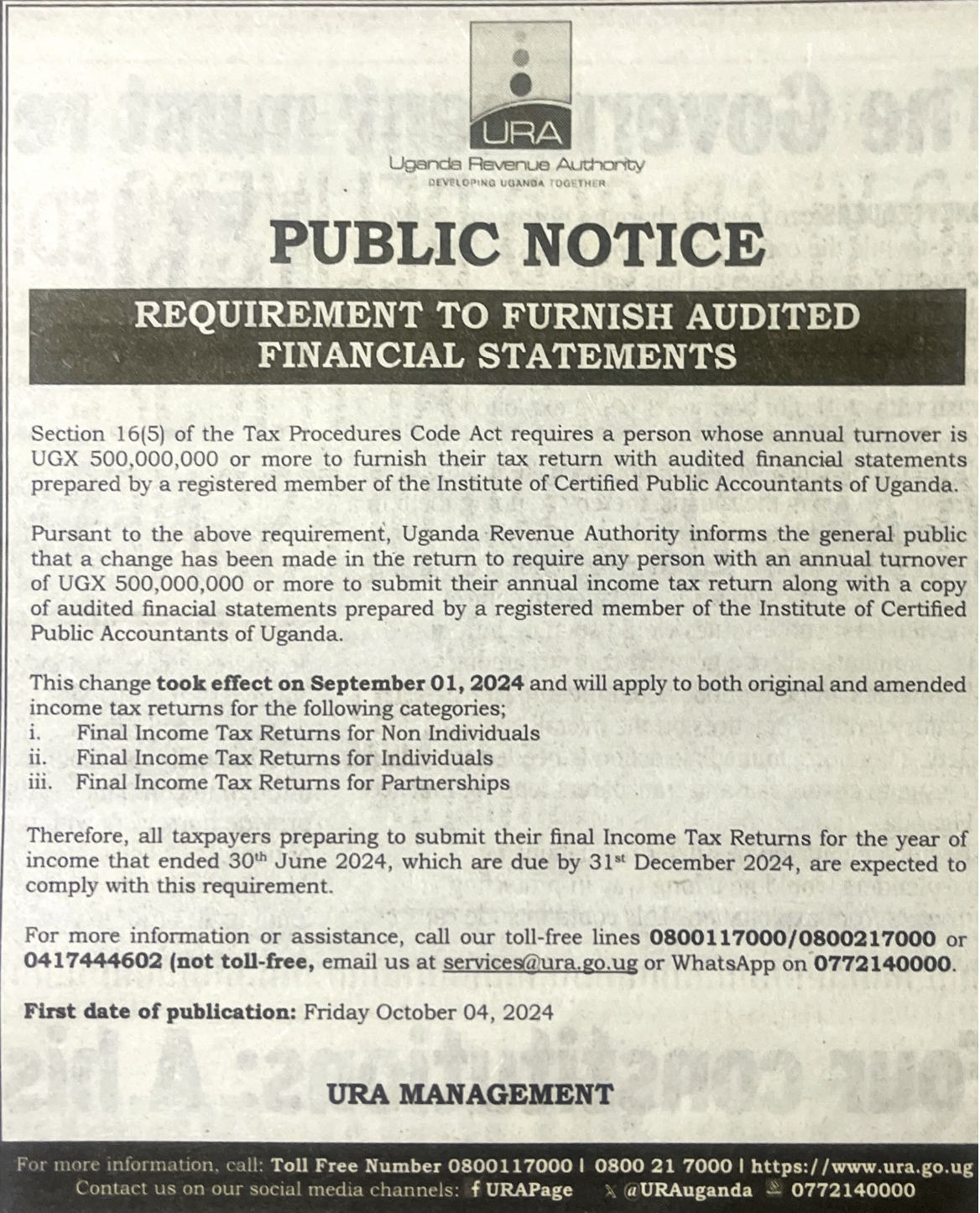

The Uganda Revenue Authority (URA) now requires all individuals, partnerships, and companies with an annual turnover of UGX 500 million or more to submit their annual income tax return along with audited financial statements. These statements must be prepared by a registered member of the Institute of Certified Public Accountants of Uganda (ICPAU).

In light of this, we strongly recommend that you review your annual turnover, and should it be more than the set threshold of UGX 500 million, you should ensure that the audit process (for any of your impacted entities) is completed by the due date of filing the Income Tax Return, i.e., by December 31, 2024, for the fiscal year ended June 30, 2024.

If we can be of any help or should you have any questions in this regard, please feel free to reach out to us at info@ardenfield.com or 0784 597 011 by phone. We would be happy to help!